Imagine walking into a dealership and the salesman says, “You can drive this brand new car home today with zero dollars down.”” Sounds tempting, right? But here’s the real question: Is a no money down car loan actually a good deal, or is it a financial trap waiting to happen? Today, we’re going to break it down step by step, how these loans work, the hidden dangers most people miss, and when it might actually make sense to take one.

By the end of this video, you’ll know whether a no money down car loan is your dream deal or a debt disaster in disguise. Number one, what no money down really means. When a dealer says no money down, it simply means you don’t have to make an upfront payment before driving off with your new car.

Usually, when you buy a car with financing, you’re expected to make a down payment, maybe 10% or more of the car’s price. So, if you’re buying a car for $20,000, a normal deal might require $2,000 upfront. In a no money down loan, that $2,000 gets rolled into the loan itself. You’re financing the entire cost of the car.

Sometimes even the taxes, registration, and fees. It sounds like a win when money is tied, but the math tells a different story. Let’s look at an example. If you finance $20,000 over 6 years at an interest rate of 7%, your total cost is around $23,700. But if you put $2,000 down first, you’ll pay about $2,400 less in total interest.

That’s right, skipping that down payment just made your car more expensive. Number two, why people fall for no money down offers. Car dealers are masters of making deals sound irresistible. They know that most people focus on monthly payments, not total cost. If they can show you a shiny new car for just $300 a month, you’re hooked.

Even if it means you’ll pay thousands more over time. They also know timing plays a role: Tax season, holidays, or back to school months, those are peak times for zero down ads. They use phrases like “drive today, pay later,” or “no money down for qualified buyers.” But here’s the catch: Only a small percentage of buyers actually qualify for those advertised terms.

And even if you do, you might get hit with higher interest rates to make up for it. Dealers aren’t losing money; they’re just moving the numbers around to make you feel like you’re getting a deal. Number three, the hidden cost of skipping the down payment. When you don’t put money down, you’re financing more than the car is worth.

Here’s why that’s dangerous: Cars lose value fast. The moment you drive off the lot, your new car drops about 10% in value. After one year, it’s usually worth around 20% less. So, if your loan is for $25,000 and your car is only worth $20,000 after a year, you’re upside down, meaning you owe more than the car is worth.

Now, if the car gets stolen or totaled, your insurance will only cover the car’s market value, not your loan balance. That means you could still owe thousands on a car you no longer have. And that’s not even counting the extra interest. A small monthly difference might not sound like much, maybe $40 or $50 more per month, but over a five or six-year term, that adds up to thousands of dollars.

Number four, the role of credit scores. Dealers often use no money down deals to attract people with weaker credit. If you have a credit score below 650, lenders see you as risky. They might approve you, but with a much higher interest rate, sometimes 12% or even higher. Let’s use an example: If you buy a $25,000 car at a 12% interest rate for 6 years, your total cost could end up close to $35,000.

That’s $10,000 more than the sticker price, all because you didn’t put money down and had a lower credit score. So, if you’re rebuilding your credit, it might be smarter to wait, save up a small down payment, and get a lower interest rate later. Number five, when a no money down loan might actually make sense.

Yes, there are rare cases where it could be a smart move. For example, if you qualify for 0% financing, meaning you pay no interest, then a no money down loan can make sense. That’s because you’re borrowing for free. Or maybe you have the cash for a down payment, but your money could earn more elsewhere. Let’s say you’re offered 0% financing and you have $5,000 ready to put down.

Instead, you could invest that $5,000 in a high yield savings account earning 5% annual interest; you’d come out ahead. Another time it could make sense is if you need a car urgently for work. Maybe your old one just died and you can’t get to your job without a new one. In that case, a no money down loan might be your best short-term lifeline.

The key is to treat it as a temporary fix, not a long-term habit. Number six, the upside down loan trap. Let’s talk about what happens when things go wrong. Imagine you buy a car for $27,000 with no money down. Six months later, you still owe $25,000, but the car’s market value has dropped to $22,000. Now you’re upside down by $3,000.

If you try to trade in the car, that $3,000 gap doesn’t disappear; the dealer just adds it to your new loan. So, your next car starts out with negative equity. You’re already in the hole before you even start driving. That’s how people end up rolling debt from car to car year after year. You’re basically renting your lifestyle on credit.

And that’s how people stay broke, even with nice cars in their driveway. Number seven, how to protect yourself from bad car deals. Before you even walk into a dealership, check your credit score and get preapproved for a loan from your own bank or credit union. That way, you know exactly what interest rate you deserve.

Then, use an online car loan calculator to see what happens if you add or remove a down payment. “Play with the numbers.” It’s eye opening. Also, consider the total cost of ownership, not just the monthly payment. That includes gas, maintenance, insurance, and registration. Dealers love to hide those details because it distracts you from how expensive the car truly is.

And if you do take a no money down deal, think about adding gap insurance. Gap insurance covers the difference between what you owe and what your car is worth if it gets totaled. It’s a small cost that can save you thousands. Number eight, smart alternatives to no money down loans. If you’re struggling to come up with a down payment, there are better strategies.

Start by buying a used car instead of new. A 2-year-old car often costs 20 to 30% less, but drives just as well. You can also look into certified pre-owned vehicles: They’re inspected, come with warranties, and often qualify for good financing terms, or save up gradually. Even a down payment of $1,000 or $1,500 can lower your total cost significantly.

Another smart move is improving your credit score before applying: Pay down credit cards, fix errors on your credit report, and make on-time payments for a few months. That small effort could lower your interest rate enough to save thousands over the life of your loan. Number nine, the real question.

Can you afford the car? Here’s a rule of thumb: If you need a zero down deal just to afford the monthly payment, you probably can’t afford the car. Cars are emotional purchases; they represent freedom, status, comfort, but at the end of the day, they’re depreciating assets. A reliable car that gets you from point A to point B is better than a flashy one that drains your wallet.

Try to keep your car payment under 15% of your monthly take-home pay. And if you can buy used, reliable, and with cash, that’s the ultimate power move because nothing feels better than driving a car that’s completely paid off. Number 10, the power of depreciation and timing. Many beginners overlook how fast cars lose value, but timing your purchase can make a huge difference.

Brand new cars lose roughly 10% of their value in the first month and about 20% by the end of the first year. If you buy with $0 down, you’re instantly financing something that’s already worth less than what you owe. Here’s an example: You buy a car worth $30,000 with no down payment. After one year, it’s worth $24,000, but you still owe around $28,000.

That’s a $4,000 gap, and you haven’t missed a single payment. One way to protect yourself is to buy cars that hold their value better. Brands like Toyota, Honda, and Subaru tend to depreciate more slowly. Another trick is to buy right after the new model year comes out. Dealers often discount last year’s models to clear inventory, which means you could pay less and avoid some instant depreciation.

Number 11, the insurance cost connection. People often forget that skipping a down payment also affects insurance costs. When you owe more on your loan, lenders require full coverage, both comprehensive and collision. That’s because the car technically belongs to them until you finish paying it off. With a bigger loan balance, your insurance premiums may be higher, too.

So, even though you didn’t pay upfront, you’re paying extra every month. Here’s a quick example: If you’re paying $120 per month for insurance on a modest loan, that might jump to $150 when your loan balance is higher. That’s an extra $30 per month or $360 a year. It’s not a huge number by itself, but combine it with extra interest and fees and the total cost really starts to grow.

Number 12, beware of balloon or deferred payment offers. Some dealerships mix no money down with no payments for 90 days. Sounds amazing, right? But what’s really happening is that the loan term is stretched out and interest keeps piling up during those 90 days. You end up paying interest even before you make your first payment. Worse, some loans include a balloon payment at the end, a large lump sum that you must pay all at once after several years.

Many buyers don’t notice that detail until it’s too late. So, always read the fine print carefully. If you see words like “deferred payments” or “a balloon payment,” take a step back and ask, “What’s the real total cost here?”

Number 13, the psychological trap of easy credit. No money down loans are designed to make you feel like you can afford more than you actually can. When you don’t have to part with cash upfront, your brain perceives the purchase as less painful. That’s called the “pain of paying effect,” and marketers know exactly how to use it. So instead of buying a modest $20,000 car, you might stretch to a $30,000 one because it’s “only a few more per month.” That’s where financial discipline must kick in.

Just because a lender approves you doesn’t mean you can comfortably afford it. Remember, the bank’s job is to make money from interest; your job is to protect your wallet. Number 14, trade in traps and negative equity loops. If you already have a car loan, dealers might promise to pay off your trade in, even if you owe more than the car is worth.

What they don’t tell you is that they’re simply rolling your old loan balance into your new one. So, if you owe $3,000 more on your current car than it’s worth, and you buy another with no money down, that $3,000 gets added to your new loan. Now, you owe even more than before, and your fresh start becomes another debt cycle.

The best way to avoid this trap is to pay off your existing car before trading it in or sell it privately; you’ll usually get a higher price than the dealer offers. Number 15, the impact of loan length. Dealers often stretch no money down loans to six, seven, or even eight years just to make the monthly payment look smaller.

But longer loans come with two major problems: more interest and slower equity growth. Let’s say you take a $30,000 loan for 8 years at 6% interest; you’ll pay almost $40,000 in total. That’s $10,000 extra just for the privilege of smaller payments. And because you’re paying it off so slowly, you’ll stay upside down longer, meaning you’ll owe more than the car is worth for several years.

If possible, stick with a loan term of 5 years or less. It may raise your monthly payment slightly, but you’ll save thousands overall and build equity faster. Number 16, hidden fees and dealer add-ons. When you don’t make a down payment, some dealerships add hidden fees to the loan. They might tack on things like extended warranties, paint protection, or tire packages.

You might hear, “Don’t worry, it’s just a few dollars more per month,” but those few dollars can turn into thousands over the full term of the loan. Always ask for a breakdown of every fee before signing. If you see items you didn’t ask for, tell them to remove them. Dealers rely on people being too excited or too tired to notice these add-ons.

Knowledge is your best protection. Number 17, leasing as an alternative. If you want to drive a new car without a big down payment, leasing might be a smarter option. With a lease, you pay for the depreciation instead of the full cost of the car. That usually means lower monthly payments. However, there’s a catch.

You don’t own the car, and you’ll have mileage limits. If you drive too much or damage the car, you’ll owe extra at the end. Still, for some people, especially those who prefer upgrading cars every few years, leasing can make more sense than a long, expensive loan. The key is to understand the trade-off: low payments today in exchange for no ownership tomorrow.

Buying a car is exciting, but excitement can cloud judgment, especially when dealers dangle offers that sound too good to be true. A no money down car loan can seem like instant gratification until the monthly bills, high interest, and negative equity come crashing in. So, here’s the final question.

“Would you rather drive a new car today and owe thousands more tomorrow, or wait a little, save smart, and own your car with peace of mind?” “What do you think? Are no money down car loans worth it, or just a shiny trap?” “Share your thoughts in the comments below.”

News

“WAIT—WHAT JUST HAPPENED?!” — Hairstylist Leaves Ryan Seacrest STUNNED With a $75,000 Wheel of Fortune Win That No One Saw Coming!

“WAIT—WHAT JUST HAPPENED?!” — Hairstylist Leaves Ryan Seacrest STUNNED With a $75,000 Wheel of Fortune Win That No One Saw…

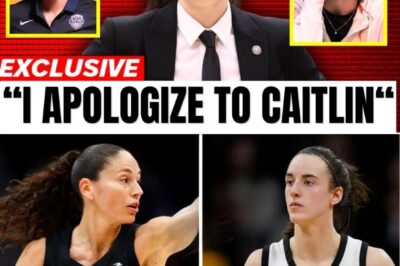

CLARK QUITS! Bench War Turns into National Team Nightmare as Sue Bird Issues Apology in Team USA’s Biggest Crisis Since 1996

BENCH BLOWOUT: Caitlin Clark Walks Out on Team USA After On-Court Crisis, Triggering Public Apology from Legend Sue Bird…

Sophie Cunningham’s Secret Dream: The WNBA Star Who Silenced Good Morning America and Became an Instant Media Sensation

From Court Star to Media Queen: Sophie Cunningham’s Unforgettable Morning America Takeover The WNBA’s Fiercest Competitor Reveals the Childhood…

HOLLYWOOD’S GREEK TRAGEDY: JUSTICE DEPARTMENT EYES TOM HANKS’ SECLUDED ISLAND PARADISE

Attorney General Pam Bondi claims the Justice Department is on the verge of securing authorization from the Greek government to…

SWIFTIE BOMB DROPS: The ‘Opalite’ Set Secret, A Disney+ Finale, and The Viral ‘Fiancé’ Leak—Taylor Swift’s December is a High-Stakes Game of Clues!

TAYLOR SWIFT’S DECEMBER DETONATION: Is the ‘Opalite’ Music Video Landing? Plus, Unpacking the Disney+ Finale and the ‘Fiancé’ Bomb…

THE DOMINATOR’S DECREE: Patrick Mahomes Throws Down His ‘No Hope’ Manifesto—Why The Chiefs Don’t Seek Victory, They COMMAND It!

🏈 THE MAHOMES MANIFESTO: Why the Chiefs Don’t Just Play — They Take Over The energy radiating from Arrowhead…

End of content

No more pages to load