New Investigation Reveals Elon Musk’s “Charity” Is Just a Tax Loophole: No Staff, Donates to Himself

Elon Musk’s charitable contributions appear to be more about self-promotion than genuine altruism. Despite receiving tax exemptions worth $2 billion, his charity operates without staff and seems to primarily serve his personal interests.

A Charity with No Staff

Elon Musk is now facing the possibility of billions in fines after a new investigation uncovered troubling details about his charitable foundation. While other billionaires like Bill Gates have poured money into improving healthcare in Africa and the Walton family has pushed to reform U.S. education, Musk—the second richest man in the world—appears to be using philanthropy primarily for his own benefit.

According to The New York Times, Musk has continuously built his eponymous foundation with tax-deductible stock donations totaling over $7 billion, briefly making it the largest private foundation in the U.S. at the time. However, tax filings revealed that the Musk Foundation has no full-time employees. Its multi-billion-dollar operations are managed by a board consisting of Elon Musk himself and two part-time volunteers.

Volunteer Matilda Simon, a personal staff member for the Musk family, told the Times she spends about six minutes per week on the foundation. The other member, Jared Birchall, Musk’s family wealth manager, contributes just one hour per week.

Despite Musk’s belief that his business ventures already do more good for the world than most philanthropy, the law requires that a tax-exempt nonprofit operate in the public interest, not for personal gain. Legal experts warn that Musk could face significant penalties for exploiting legal loopholes to avoid taxes.

Musk’s Charitable Giving Tied to His Own Interests

The New York Times investigation shows that during 2021–2022, roughly half of the Musk Foundation’s donations were connected to Musk’s business or personal interests.

For example:

$55 million went to aid a major client of SpaceX.

Donations were made only after an explosion from a SpaceX Starship rocket affected tens of thousands of residents in Cameron County, Texas—where SpaceX is based.

Two schools received funding from the foundation: one within the SpaceX complex, and the other adjacent to a new Tesla employee housing site.

Urban Institute scholar Benjamin Soskis noted that while many billionaires aim to maximize societal impact, Musk’s philanthropy appears to have no clear strategy—instead, it’s closely tied to his own businesses.

Before March 2021, the Musk Foundation had never made any contributions to Cameron County, one of Texas’s poorest areas. It only began donating after a SpaceX rocket exploded, drawing public scrutiny.

A Private School for His Own Children

Musk and his brother Kimbal established the Musk Foundation in 2001 after Elon sold PayPal to eBay for $1.5 billion, pocketing $175 million and donating $2 million in stock to the foundation.

While the foundation’s website features colorful animations and messages encouraging public donations, reporters found that it has no public contact information from 2005 to the present.

Despite having a net worth of over $195 billion, Musk has given away very little in true philanthropy. He once claimed:

“Tesla has done more for the environment than all other companies combined. As its leader, I’ve done more for the planet than anyone else alive.”

The majority of the foundation’s disbursements go to causes connected to Musk or his close associates—including events organized by his brother.

The Musk Foundation also funded the Ad Astra school, a nonprofit private school founded by Musk for his own children and those of Tesla and SpaceX executives.

According to principal Joshua Dahn, five of Musk’s children attend the school, and the majority of students are children of SpaceX employees. Two former anonymous SpaceX executives described the school as a “perk for executives” inaccessible to regular employees.

Lack of Strategy, Lack of Transparency

The Musk Foundation’s disbursements are scattershot, with no clear strategic direction. Many donations are tied to Musk’s business commitments rather than any broader social vision.

In 2016, Musk donated $254 million in Tesla stock to the foundation. Shortly after, $10 million went to OpenAI—the organization behind ChatGPT—a group Musk co-founded. Subsequent donations also closely aligned with his business interests.

Charity Used for Tax Savings

In late 2021, Musk received a $25 billion stock bonus from Tesla and faced an $11 billion tax bill—the largest in U.S. history. That same year, under advice from legal counsel, Musk began ramping up charitable activity to lower his tax burden.

In October 2021, Musk publicly offered to donate $6 billion to the UN’s World Food Programme (WFP) by selling Tesla shares. While the WFP developed a plan, Musk never followed through.

Instead, he funneled $5.7 billion worth of Tesla shares into his own foundation—helping it become one of the 20 largest private foundations in the U.S., and saving Musk more than $2 billion in taxes.

Under U.S. law, foundations must spend at least 5% of their assets each year. For the Musk Foundation, that would mean hundreds of millions in annual disbursements. But it hasn’t met that requirement.

In 2021, it fell short by $41 million. In 2022, the shortfall grew to $193 million, with the foundation giving away just 2.25% of its $7 billion in assets. This made Musk’s foundation one of the four worst-performing major U.S. foundations by this standard.

No 2023 disbursement data has been released. If the foundation continues to fall short, it may face IRS penalties of up to 30% of the amount not distributed since 2022.

Even His “Generosity” Drives Business

Even when the Musk Foundation does donate, the gifts often circle back to his businesses. For instance:

The foundation gave $5 million to a UN program to provide rural schools with internet access via SpaceX’s Starlink satellites.

At least two of those countries later became paying Starlink customers.

Conclusion: Charity or Self-Interest?

The investigation paints a stark picture: Elon Musk may be using philanthropy to fund himself while avoiding billions in taxes. If this trend continues, Musk could soon face major government scrutiny and multi-billion-dollar penalties for exploiting charitable laws.

News

OPRAH IN SH0CK! Ice Cube Drops BOMBSHELL Confessions That Leave Oprah Speechless – Hidden Truths, Hollywood Scandals, and the Revelation No One Saw Coming!

Oprah Stunned as Ice Cube Calls Out Hollywood’s Dark Side In a jaw-dropping revelation, Ice Cube has stirred up major…

‘We Couldn’t Stay Silent Any Longer’ — Oprah Winfrey and Gayle King Finally Break Their Silence on the Rumors That Refuse to Die: The Truth Behind Their Relationship and Why Millions Still Believe They’re More Than Just Friends

Oprah Winfrey and Gayle King Respond to Longstanding Relationship Rumors Oprah Winfrey and Gayle King have shared a decades-long friendship…

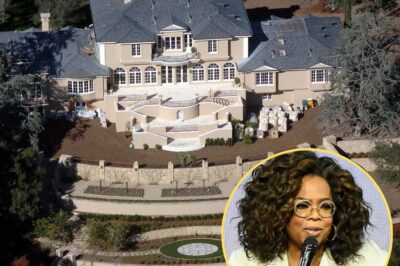

INSIDE OPRAH’S $50M PARADISE: Fans STUNNED as She Opens the Doors to Her Ultra-Luxurious Montecito Mansion – The Queen of Talk Finally Reveals Her Private World…

Oprah Winfrey gives fans a peek inside her lavish $50M Montecito mansion as she makes purple mocktails… after weight loss…

“OPRAH KNEW SOMETHING.” Gayle King Finally Reveals the Eerie Words Oprah Whispered After Her Space Flight — And It’s Nothing Like You’d Expect…

Gayle King Shares Oprah Winfrey’s Emotional Reaction to Her Space Flight Gayle King recently opened up about what her best…

SH0CKING TWIST: P. Diddy’s SECRET TIES to Oprah Winfrey Finally EXPOSED—Why She Stayed Silent for YEARS Will Blow Your Mind…

Who Is John Pelleteer? The Police Chief Whose Name Keeps Surfacing in America’s Most Disturbing Scandals What started as an…

ABC News star SUSPENDED over late-night clash with Trump and top White House officials

ABC News’ political correspondent Terry Moran has been suspended after slamming a Trump adviser in a late night post on…

End of content

No more pages to load