Tesla shares fell more than 8% in trading on February 25, erasing almost all of the gains since President Donald Trump, who has a close relationship with the electric carmaker’s CEO Elon Musk, was re-elected in early November.

The 8.4% drop pushed Tesla’s market capitalization below the $1 trillion mark. Tesla shares closed at $302.80 a share, giving it a market capitalization of nearly $949 billion – its lowest level since November 7, two days after Trump won the 2024 US presidential election.

Tesla shares have fallen 25% this year, while the Nasdaq – the US stock index of which Tesla is a member – has fallen only 1.5%. Compared to the record set on December 16, Tesla shares are now down more than 35%.

Since Tesla’s stock peaked, Musk has lost about $130 billion in net worth. On February 25 alone, his net worth fell $22.2 billion, marking the fourth-biggest one-day drop ever. Still, Musk is worth about $358 billion and is the richest person in the world, according to the Bloomberg Billionaires Index, the 500 richest people on the planet.

Compared to the time before Trump won his second term as president, Musk’s fortune is now about $100 billion higher. Tesla’s stock has lost most of its post-election gains, but Musk’s fortune has still increased because, in addition to nearly half of Tesla’s shares, he also owns shares in other companies that are not listed on the stock exchange, such as xAI, SpaceX, X, Neuralink, and The Boring Company.

Tesla shares have been under heavy selling pressure from investors as Wall Street dumps tech stocks in recent sessions amid concerns about a worsening US economic outlook due to escalating trade tensions.

Trump’s key policies, including cuts to the federal budget and tariffs on imported goods, are putting downward pressure on the US stock market – contrary to his campaign promise to create a booming market. The S&P 500 has fallen 3.1% over the past four trading days, while the Magnificent 7 Index – an index measuring the prices of seven large-cap technology companies – fell into correction mode on February 25.

The selling pressure on Tesla shares has been further exacerbated by the fact that Musk – who heads the Department of Government Efficiency (DOGE) in the Trump 2.0 administration – has been embroiled in controversy over his efforts to lay off a large number of federal employees to cut costs.

In addition, Tesla shares on February 25 also faced downward pressure from a Reuters article saying that the latest upgrade to Tesla’s partial self-driving system disappointed users. Many users revealed to Reuters that Tesla’s self-driving feature on Chinese streets did not reach the level that Mr. Musk promised about self-driving technology.

The information increased concerns of Tesla shareholders. Part of that concern stems from the company’s recent business results, and part is related to Mr. Musk – who is spending too much time on work at DOGE.

Along with his team, Mr. Musk has unprecedented access to federal computer systems and taxpayer data. Mr. Trump also gave Mr. Musk the right to fire a series of civil servants in government agencies, including those with the authority to supervise Mr. Musk’s companies like Tesla.

Musk’s alleged extreme actions in DOGE have led to protests against him, including at Tesla dealerships and service centers.

Meanwhile, Tesla’s fourth-quarter 2024 results delivered both revenue and profit that fell short of analysts’ forecasts, with auto sales down 8% year-over-year and operating profit down 23%. The company said that the decline in average selling prices of its older product lines, including the Model 3, Model Y, Model S and Model X, was the main reason behind the decline in revenue and profit.

According to the California New Automobile Dealers Association (CNADA), Tesla’s vehicle sales in the state fell 11.6% in the fourth quarter of 2024. California is Tesla’s largest market in the US.

News

Michael Jordan met his old coach when he was poor, STRUGGLING FOR LIFE working two HARD JOBS at 75 AND ACTING TO AVOID HIM – Michael Jordan’s subsequent actions made him cry.

L’histoire émotive entre Michael Jordan et son prétendu ancien entraîneur de jeunesse, Vernon Halliday, est fausse. Selon Snopes, un site…

🚨 SHOCKING MOVE! LAKERS ACQUIRE STARS CENTER TO SUPPORT STARS IN THE PAINT!

Lakers’ Costly 2019 Trade Continues to Haunt Them in 2025 Amid Frontcourt Crisis Looking back from 2025, one of the…

Stephen A. WARNS Ant-Man about Luka Doncic’s Lakers 🗣️ ‘YOU BETTER SHOW UP!’

📌 Current Situation of the Dallas Mavericks Important win over the Kings: Combining Anthony Davis (yes, he’s on the Mavs…

Will Golden State spoil Houston’s run? 👀 + What’s considered success for the Lakers? 🤔

This video brings an exciting and twisty narrative about the current NBA scenario, mainly around the Golden State Warriors,…

Stephen A. RIPS the Dallas Mavericks for Nico Harrison’s meeting & the Luka trade 😳

Dallas Mavericks Face Backlash Over Controversial Trade and Leadership Decisions The Dallas Mavericks are currently under intense scrutiny after a…

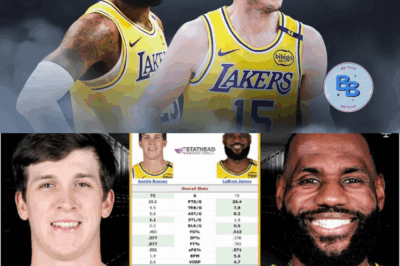

🚨THIS LEBRON JAMES STAT EXPOSES HOW THE NBA CONTINUES TO CHEAT FOR LAKERS GUARD AUSTIN REAVES!

LeBron James gets 100% real about Austin Reaves’ ejection after refs ‘F-bomb’ explanation The claim that a specific LeBron James…

End of content

No more pages to load