n who usually dominated finance. He didn’t wear tailored suits or polished shoes. He wore baggy shorts, wrinkled T-shirts, and sneakers that looked like they’d lost arguments with sidewalks. His hair seemed permanently unbrushed, as if grooming were an unnecessary distraction from higher thinking. He slept on a bean bag in his office, or so the stories went, and he spoke in long, rambling sentences that felt more like thoughts escaping his head than statements meant for an audience.

To a world already suspicious of polished bankers, Sam felt safe.

He was young, awkward, brilliant. A math prodigy who claimed he wanted to get rich only so he could give it all away. A vegan utilitarian who talked about saving lives in expected-value calculations. A once-in-a-generation mind, people said. The Michael Jordan of crypto. The kind of person who came along once, maybe never again.

That story was intoxicating. And like most intoxicants, it hid its poison well.

Sam was born into comfort and intellect, raised by two Stanford law professors who taught him to argue precisely and think abstractly. From early on, he learned to see the world as a system—inputs, outputs, probabilities, trade-offs. Morality, to Sam, was not emotional; it was mathematical. If one action saved more lives than another, it was the right action, even if it felt uncomfortable. Especially if it felt uncomfortable.

In college, he encountered a philosophy that would shape everything that followed: effective altruism. The idea was seductively simple. If you truly wanted to do good, you shouldn’t chase feel-good charity work. You should chase money—vast amounts of it—so you could later deploy it where it mattered most. “Earning to give,” they called it. Get filthy rich for the sake of humanity.

Sam embraced it completely.

Instead of working at a nonprofit, he joined Jane Street, a high-frequency trading firm where intelligence was currency and risk was a tool. He made money quickly. But not quickly enough. Crypto, in 2017, was exploding with the promise of infinite upside and minimal restraint. Sam saw inefficiencies—price differences between exchanges, regulatory gaps, blind optimism. Where others saw chaos, he saw opportunity.

He left Jane Street and started Alameda Research, a crypto trading firm that sounded like a quiet academic institution but behaved like a high-risk casino. At first, it worked. Arbitrage trades between the U.S. and Asia generated millions. Investors and fellow effective altruists poured in money, convinced they were backing not just profit, but purpose.

But the early success didn’t last.

By 2018, Alameda was bleeding. Internal conflicts erupted. Employees accused Sam of reckless trading, of ignoring risk controls, of treating rules as optional obstacles. Half the team quit in what became known internally as the “April Fiasco.” Warnings were raised to the effective altruism community. Many went unheard.

Sam stayed.

And instead of slowing down, he built something bigger.

In 2019, he launched FTX, a cryptocurrency exchange designed to be sleek, fast, and trader-friendly. Exchanges were gold mines: they made money on every trade, regardless of who won or lost. Better yet, they were trusted intermediaries. People deposited their assets and assumed they would remain untouched.

FTX grew quickly. Helped by Alameda, which provided early trading volume, it attracted users and investors alike. Venture capital firms lined up. Celebrities signed endorsement deals. Sports arenas took the FTX name. Super Bowl ads told millions not to “miss out.” Sam became crypto’s golden boy—the billionaire who didn’t want yachts, who wanted to save the world.

At its peak, FTX was valued at $32 billion.

What almost no one noticed—or chose not to question—was the structure underneath.

Sam owned both FTX and Alameda Research. The exchange and the trading firm were supposed to be separate. In theory, Alameda was just another customer. In practice, it was anything but. It had special privileges. Exemptions from liquidation rules. Access no other trader had.

And most dangerously, it had access to customer funds.

This was the midpoint—the hidden fault line running beneath the entire empire. While users believed their money sat safely on FTX, billions were being quietly funneled to Alameda to cover losses, fund trades, and sustain the illusion of success. The system held together as long as markets went up and confidence remained intact.

Then crypto winter arrived.

In 2022, one major crypto project after another collapsed. Terra-Luna imploded, wiping out tens of billions. Hedge funds failed. Lenders froze withdrawals. Panic spread. And yet, FTX appeared strong. Sam positioned himself as the industry’s savior, offering bailouts and credit lines, earning comparisons to J.P. Morgan.

Behind the scenes, the foundation was crumbling.

When a leaked balance sheet revealed that Alameda’s assets were largely made up of FTX’s own token—essentially money backed by belief rather than liquidity—everything unraveled. Binance, the world’s largest crypto exchange, announced it would sell its FTX tokens. The market panicked. Users rushed to withdraw their funds.

FTX could not meet the demand.

What followed was not a slow decline, but a collapse measured in days. Withdrawal requests piled up. Sam tweeted reassurances, then went silent. A last-minute rescue deal fell apart after a brief look at the books. FTX filed for bankruptcy.

From $32 billion to zero.

The ending was not quiet.

Investigations revealed a company with no real financial controls, no proper accounting, executives communicating on auto-deleting apps, and billions of dollars unaccounted for. The new CEO, a veteran of the Enron collapse, described it as one of the worst corporate failures he had ever seen.

Sam, astonishingly, did not run.

He gave interviews. Claimed mistakes, not fraud. Suggested he hadn’t really known what was happening. The world watched in disbelief as the former crypto king spoke calmly from the Bahamas, still framing himself as misunderstood rather than malicious.

Then the handcuffs came.

In December 2022, Sam Bankman-Fried was arrested and extradited to the United States. Prosecutors charged him with orchestrating a massive, years-long fraud—stealing billions of dollars from customers to fuel his empire, make political donations, and sustain the image of a benevolent genius.

The people who turned against him first were the ones closest to him. Former executives pled guilty. Testimony poured out. The myth collapsed completely.

And what remained were the victims.

Not institutions. Not celebrities. Ordinary people who believed the story. Who trusted the awkward billionaire who said he wanted to save the world. Who put their savings into a system built on confidence and discovered, too late, that confidence was the only thing holding it up.

Sam Bankman-Fried’s story is not just about crypto. It’s about how easily intelligence can be mistaken for integrity, how morality can be weaponized, and how a compelling narrative can silence doubt at every level.

The most unsettling part is not that it happened.

It’s how reasonable it all seemed—right up until the moment it didn’t.

News

Substation No. 9: Flooded Tunnels, Vanished Workers, Endless Basements, Broken Flashlights, and the Quiet Industrial Horror Waiting Beneath Concrete, Water, Rust, and Human Forgetfulness

I. The Place Nobody Notices Substation No. 9 existed in a place people passed without seeing. Forests, streams, and empty…

SCP-001 Black Moon: An Apocalyptic Chronicle of Sin, Observation, Immortality, Failed Containment, Cosmic Judgment, and Humanity’s Final Attempt to Stare Into the Darkness Without Blinking

I. The Sin That Watches Back Before humanity learned to count years, before names were necessary, there existed something watching…

SCP-2439 Unnamed Horror: A Forbidden Idea, Prisoner Whispers, Silent Lamps, Mental Contagion, and the Terrifying Secret the SCP Foundation Erased Before It Erased Them

I. The Wall That Should Not Be Read They told me not to look at the wall, which of course…

Chaos Insurgency Unmasked: The Secret War Behind the SCP Foundation, Hidden Betrayals, Forbidden Experiments, Weaponized Anomalies, and a Truth the World Was Never Meant to Know

Hello everyone for those who are not yet members You know, I’m a surveillance officer You must be a high-level…

Total War of the Unthinkable: When Kaiju Rose, Reality Fractured, and Humanity Learned It Was Never Alone

I can guarantee that with certainty any 10 year old kid would think that some monsters and big, terrifying robots…

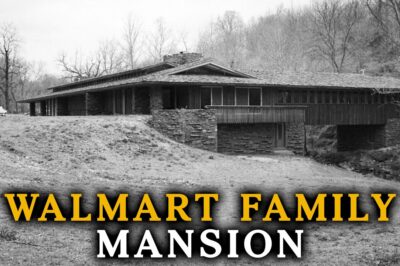

The Quiet Billionaire’s House: How Sam Walton Built the World’s Largest Retail Empire From a Home That Refused to Look Rich

When people hear the name Sam Walton, they imagine endless aisles, blue signs glowing beside highways, and shopping carts rattling…

End of content

No more pages to load